are funeral expenses tax deductible in australia

Most are work-related expenses. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate.

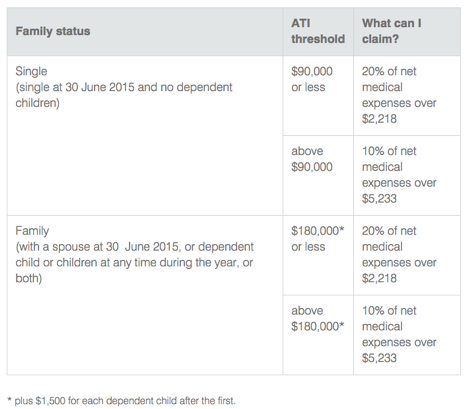

Medical Expenses Tax Offset Online Tax Australia

For most individuals this means that whether you pay in part or in full out of your pocket you cannot deduct the.

. Funeral expenses are not tax deductible because they are not qualified medical expenses. The short answer is no theyre not. These are costs you incur to earn your employment income.

When administering an estate filing tax returns and paying taxes owed are important tasks. A typical funeral will have these costs. Funerals can cost from 4000 for a basic cremation to around 15000 for a more elaborate burial.

When a person dies the legal personal representative dealing with the deceased persons tax affairs have some important tax and superannuation issues to attend to. Heres a quick look at how tax relates to funeral insurance payouts in New Zealand. Premiums paid for this type of cover are not generally tax deductible.

The general principle with tax deductions is that the item is allowable as long as the expense is incurred in earning assessable income says Corias. Funeral insurance covers you for a limited benefit usually up to 15000 to help your loved ones with the cost of your funeral if you pass away. No there are usually no changes to the tax rules around life insurance when you retire.

Permits for example for a burial at sea or private land burial or. Australian taxpayers claiming interest deductions on a financing arrangement from a related foreign interposed zero or low-rate entity broadly a jurisdiction with tax rates of 10 or less or jurisdictions that may offer tax concessions need to consider the potential application of complex integrity rules which were introduced as part of. In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes.

Funeral expenses are not tax-deductible. This cost is only tax-deductible when paid for by an estate. In some cases funeral expenses may be tax deductibleCompleting the tax returns for an estate is no easy task for those without the appropriate background and.

Yes funeral expenses are a personal expense so the family or the trust cant claim them. The estate itself must also be large enough to accrue tax liability in order to claim the deduction. Deducting funeral expenses as part of an estate.

You may need to defend it at some point of time but if you can justify the expense then the answer is you would probably get it across the line. In other words funeral expenses are tax deductible if they are covered by an estate. We translate some common expenses in other languages to help people from non-English speaking backgrounds.

Even the most humble of funerals can come with hefty price tags. Deductions you can claim. In short these expenses are not eligible to be claimed on a 1040 tax form.

While the IRS allows deductions for medical expenses funeral costs are not included. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction. While most funeral expenses are not tax deductible for individuals the rules change when the estate pays for the burial costs.

If you are thinking about getting your funeral arrangements in order so your family wont have to worry about it then you might also be wondering if there is a tax deduction for prepaying for your funeral. The IRS deducts qualified medical expenses. Are funeral expenses tax deductible in Australia.

Remember this information is intended as a guide only and is not tax advice. The answer may disappoint you. The IRS says that if the estate pays the funeral costs such as when using pre-paid plan the estate can use the expenses against its taxes as a deduction.

Tax on funeral insurance payouts. Determining if Funeral Expenses Can be Tax Deductible. There are no inheritance or estate taxes in Australia.

Deductible medical expenses may include but are not limited to the following. When completing your tax return youre able to claim deductions for some expenses. A death benefit is income of either the estate or the beneficiary who receives it.

They are never deductible if they are paid by an individual taxpayer. Can I deduct funeral expenses probate fees or fees to administer the estate. Notifying us of a deceased person tell us you are the authorised person for the deceased person.

March 30 2021 Burial or funeral insurance is tax-deductible or not is a commonly asked question. Who reports a death benefit that an employer pays. Most of the individuals cant claim burial expenses as tax-deductible.

Those testing expenses will be tax deductible the treasurer will say on Monday Comes as Prime Minister Scott Morrison considers opening border to tourists By Colin Brinsden For Australian. Individual taxpayers cannot deduct funeral expenses on their tax return. These are personal expenses and cannot be deducted.

Who doesnt qualify for deductions An individual taxpayer is not entitled to. What expenses can I. Qualified medical expenses include.

In fact many people find it difficult to cover the cost of a funeral without experiencing at least a minor financial hardship. As stated by the IRS paying for funeral or cremation expenses out of your pocket is not tax-deductible. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

Qualified medical expenses must be used to prevent or treat a medical illness or condition. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns. The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate.

The cost of arranging a funeral as well as the payout from a funeral insurance policy cannot be claimed back on tax. If the funeral expenses were paid by heirs friends charity initiatives or any source other than the deceased persons estate they do not qualify for any tax deductions. The answer to that question is no So how do.

No never can funeral expenses be claimed on taxes as a deduction. Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. That depends on who received the death benefit.

However if the expenses are paid from an individuals estate that it will be tax-deductible. To find out what guides are available. Do tax rules change when I retire.

Benefits Of Having Comprehensive Car Insurance Comprehensive Car Insurance Car Insurance Online Car Insurance

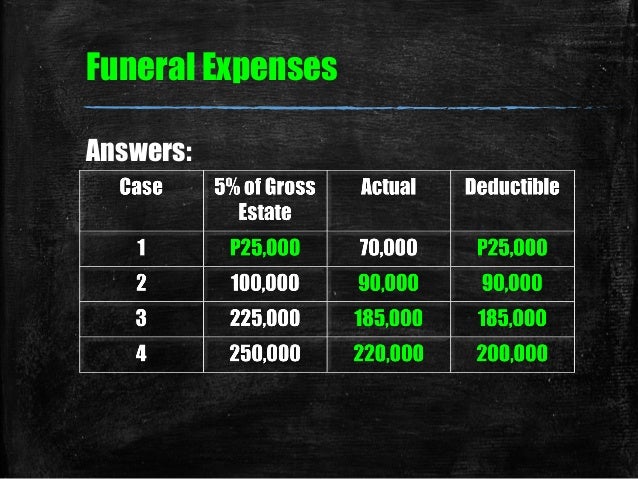

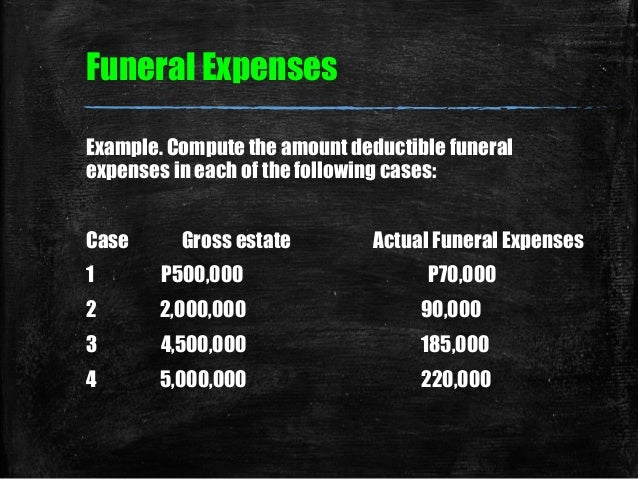

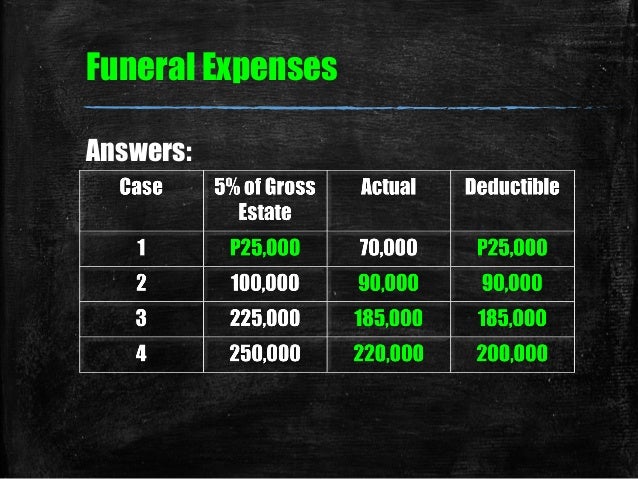

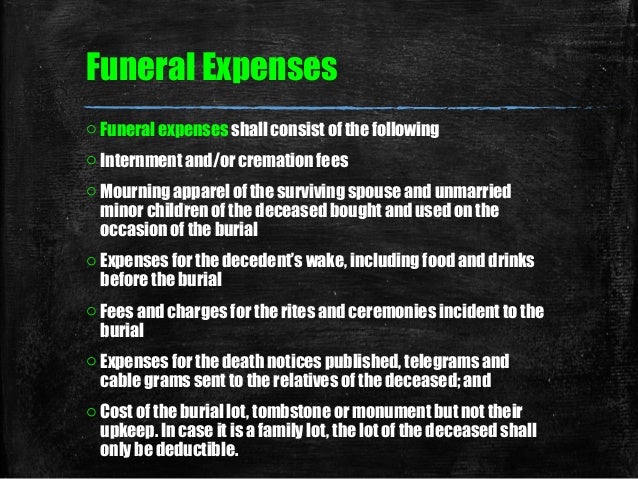

03 Chapter 4 Deductions From Gross Estate Part 01

What Tax Deductions Can I Claim Go To Court Lawyers

What Are Non Deductible Expenses Rydoo

03 Chapter 4 Deductions From Gross Estate Part 01

03 Chapter 4 Deductions From Gross Estate Part 01

Charitable Gifts And Donations Tracker Template Excel Templates Charitable Gifts Donation Letter Donation Form